Unacquired: ReadWriteWeb Pulls Out of the ZDE Deal

After weeks of delay in closing the proposed Ziff Davis Enterprise acquisition of RWW, and seeing Ars Technica and PaidContent both get bought, I decide enough is enough.

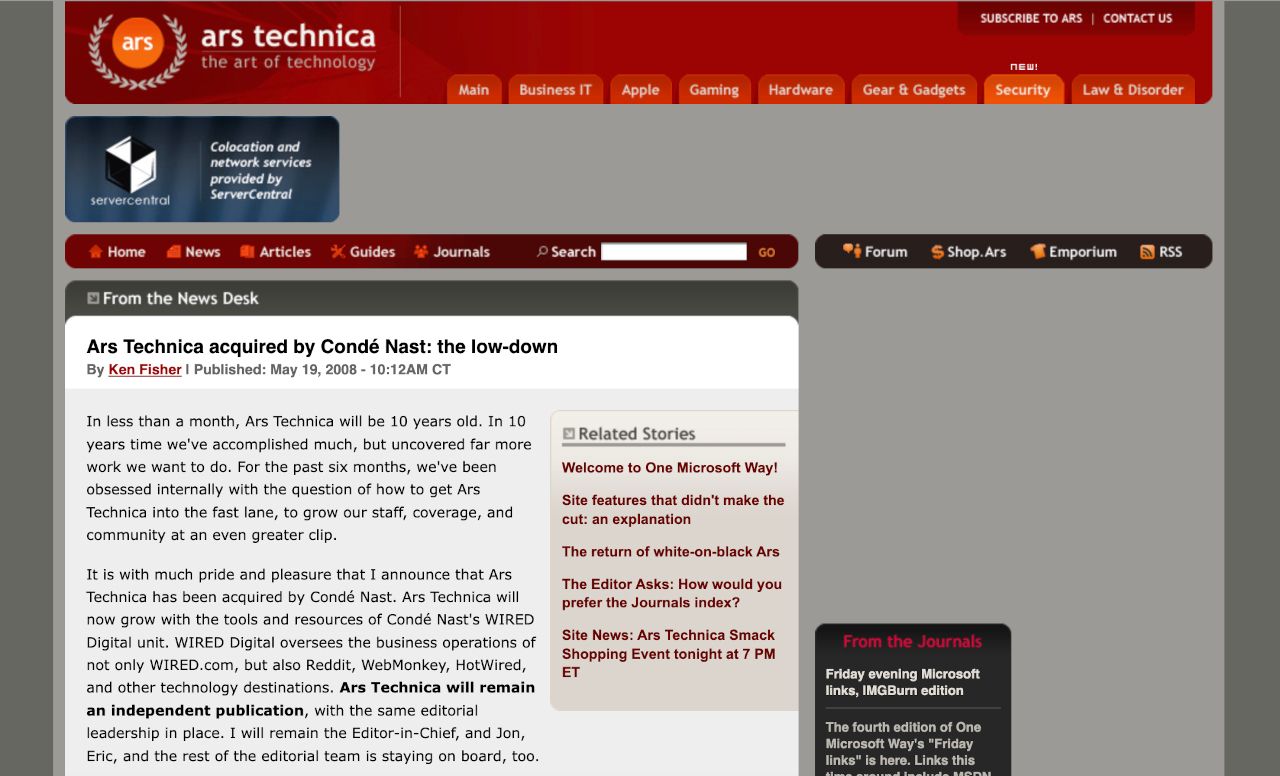

The day I left New York, I saw on Techmeme that Condé Nast had acquired the technology blog Ars Technica for an estimated $25 million. At the time (May 2008), Condé Nast also owned Wired.com and Reddit, so Ars would be joining an enviable roster. I did some back-of-the-envelope calculations and figured that it must’ve had revenue of around $2 million per year to be worth that much; that is, if it had sold for the same EBITDA multiple that I was negotiating for. RWW was on track for around $335,000 in revenue, but we were also younger and less established as a business.

When I got back to New Zealand, I was still thinking about the Ars deal and what it meant for my proposed deal with ZDE. I wasn’t too worried about the difference in sale price—Ars was a ten-year-old website that claimed to have more than five million readers and thirty million page views per month. Much of that traffic would’ve been generated by its forums, which were very popular with IT people. Nevertheless, it was an established media business and, at the time, significantly bigger than RWW.

What really caught my eye was cofounder Ken Fisher’s comment that they’d chosen to sell because they realized “an acquisition would be the quickest way to accelerate the growth of Ars.” He went on to say that “we looked positively on what Condé Nast has done with Wired.com and reddit.com (both acquired in 2006): left their leadership alone to grow their sites, while helping them with tools and resources along the way.”

As I noted to Bernard over email, I had the same reason for selling as Ars did: taking RWW to the next level and scaling its operations. However, it bugged me that I wasn’t as sure about ZDE’s ongoing support as Fisher seemed to be about Condé Nast’s. “It occurred to me that we really haven’t gotten much assurance from ZDE that they’ll be putting resources into RWW to ‘accelerate the growth’ of RWW,” I wrote to Bernard. “Should I push more for that? As of now the only assurances I have is that ZDE will attempt to take some of the admin burden off my shoulders (accounting, etc.), but other than that we’re on our own.”

The first week I was back home, Kobi Levy (my primary contact at Insight Partners) set up a phone meeting with Larry Handen, the managing partner at Insight who oversaw the ZDE business. “Larry and the rest of the team here want to move aggressively to close this deal asap, so Larry wanted to spearhead the conversation himself,” Kobi said. I was asked to have my lawyer on the call too.

The call focused on the legal structure of the acquisition, which was complicated a little by the fact that RWW was a New Zealand company. After the meeting, Insight sent me a document with a list of due-diligence requests, many of which duplicated what we had covered in New York. I was beginning to feel uneasy about all the paperwork and associated costs—my legal bills were quickly stacking up. I was also desperate to get back to focusing on RWW business and editorial. But what did I know—perhaps this was just how M&As worked?

Soon after, Larry wrote to suggest that we extend the “period of exclusivity” around the deal from June 6 to June 15. Since I had no intention of opening negotiations to other companies at this point, in practice this just meant extending the target closing date. While the delay was annoying, again I didn’t feel like I knew enough about the process to object.

Insight’s lawyers and accountants duly sent my lawyer and accountant requests for information over the next few weeks—some of which I wasn’t even cc’d on. But by June 20, there was still no end in sight for the due diligence. In particular, I wanted to see the final sale agreement document. I asked for an update, and Larry replied, “We are quite close.”

Finally, a few days later, I received a draft of the share sale agreement. However, there was an issue with the formal definition of trading profit, on which the earn-out half of the deal depended. To my mind, the definition was too complicated and included potential gotchas. Rather than have my lawyer swap PDFs with their lawyer about this crucial definition, I emailed Jake Stein, the twentysomething financial analyst at Insight I had met in New York. I hoped he would clarify matters by using the 2007 spreadsheet I’d supplied months ago as an example. “Frankly, the legalese here has me totally confused,” I wrote. “So that I can understand this definition better, Jake would you mind sending me an example of what 2007 fiscal year looks like using the above definition?”

In response, Jake promised to “create a new, simpler definition of Trading Profit.”

Another week of emails and phone calls passed, putting us a couple of days into July, so I sent an exasperated email—this time cc’ing Steve Weitzner from ZDE. “I have become a bit concerned in recent days that we are getting bogged down in legal minutiae,” I wrote. “We are now well past the date envisaged in the LOI (9 June) and these delays with the legal drafting are costing me a lot of time and money.” I added that the key remaining issue for me was the trading profit definition, “which I am not yet satisfied we have clarity on.”

Steve replied and promised to step in, but that was the last I heard from him for over a week. I had the uncomfortable feeling that Insight and ZDE were stalling—but why?

By this point Larry was only sending terse replies to my emails; most of the back-and-forth was happening with Jake. I had no issue dealing with Jake, but he was a relatively junior employee at Insight. It concerned me that I had little direct contact with the actual decision makers at Insight, or anyone senior at ZDE for that matter.

A bunch more emails full of legalese and accounting data flew back and forth between myself and Insight (and our respective lawyers), edging us toward a definition of trading profit that I could live with. But by Friday, July 11, I was fed up with the whole process. There was too much fine print on what did or did not constitute revenue and expenses, and I continued to get requests for information that I had thought we’d covered during my trip to New York City.

I wrote to Bernard that it felt like I would only achieve the earn-out “if I’m lucky and somehow squeeze my accounts into all kinds of restrictions.” It certainly didn’t feel like the kind of deal Ars Technica had agreed to with Condé Nast.

My gut feeling was that this wasn’t right. Why should I sell something I’d created and worked so hard to build up if the company acquiring it wasn’t willing to help it grow further? Perhaps, I reflected, RWW was still too young to sell—after all, Ars had taken a full decade to get to this point. I told Bernard that I’d “think more over the weekend about whether I’m comfortable proceeding.”

Over Friday and Saturday my time, there was an attempt on both sides to set up yet another phone call for the following week. But I knew that it would only kick the can further down the road, with the lawyers scuttling after to kick it some more. Enough was enough.

First thing on Monday, July 14, I sent an email to Insight and ZDE to advise that I was withdrawing from the negotiations. “It is now 5 weeks past the original deadline for closing in the LOI, and I have become increasingly frustrated over the delay and how complicated the deal structure has become,” I wrote. “This in turn has made me concerned about whether this will be an environment where RWW can work effectively to build real value.” I also no longer believed I would hit the earn-out targets. “It has become apparent that there will be too many restrictions on my ability to grow the business, and no real support,” I told them.

I noted that I had spent approximately $50,000 of my own money to get this deal done. These included legal and accounting fees, the costs of my trip to New York, and Bernard’s ongoing fees. I added that this didn’t include “the opportunity cost of trying to close this deal, when I could have been focusing on expanding the business.”

There was some back-and-forth by email and phone after that, with Steve and Kobi (the only Insight representative to respond) trying to get me to reconsider. It emerged that Insight and ZDE were pursuing another deal at the same time—although it wasn’t specified with whom. So they had been stalling! I wondered out loud to Bernard and Alex whether it was TechCrunch. Bernard suggested FM Publishing. This was all speculation, and it didn’t matter anymore.

I was ready to move on, but Kobi really wanted me to come back to the table. On Alex and Bernard’s advice, I decided to play a little hardball—I figured, what the hell? I upped the sale price by 50 percent, citing the Ars Technica deal and the even more recent $30 million sale of PaidContent.org as evidence that blog businesses had increased in value since our initial discussions. The Guardian had announced its acquisition of paidContent that very weekend, for what was likely a high EBITDA multiple, so I’d taken this as yet more evidence that ZDE was getting a bargain with RWW.

But my heart wasn’t in the negotiations anymore, and I knew it wasn’t going to happen. I just wanted to get back to writing blog posts for RWW and reconnecting with my editorial team. I’d wasted almost half a year trying to sell my business, with zero result. It was high time to get back to doing what I loved. If RWW was going to scale up, it would be as an indie media business.

This post is part of my serialized book, Bubble Blog: From Outsider to Insider in Silicon Valley's Web 2.0 Revolution. View table of contents.

Next up: 035. Indie Media Business 2.0: RWW Adds Structure and Writers

You're reading Cybercultural, an internet history newsletter. Subscribe for free, or purchase a premium subscription. Your support for this indie publication would be greatly appreciated.